|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Chapter 13: Understanding Options and BenefitsRefinancing while under a Chapter 13 bankruptcy can be a viable option for many homeowners seeking to lower their monthly payments or to switch to better terms. This article explores the essentials of refinancing during a Chapter 13 case, outlining the steps, benefits, and potential challenges. What Is Chapter 13 Bankruptcy?Chapter 13 bankruptcy, often known as a wage earner's plan, enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. The Role of the TrusteeIn a Chapter 13 case, a trustee is appointed to oversee the debtor’s plan and disburse payments to creditors. This person plays a crucial role in any refinancing attempts. Reasons to Refinance During Chapter 13

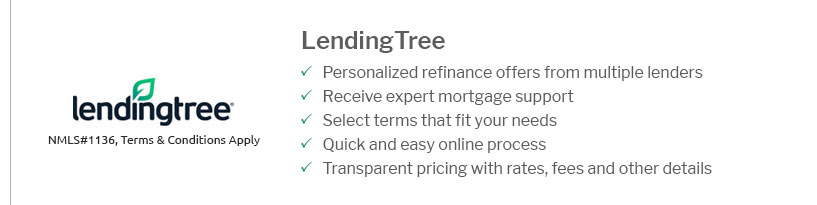

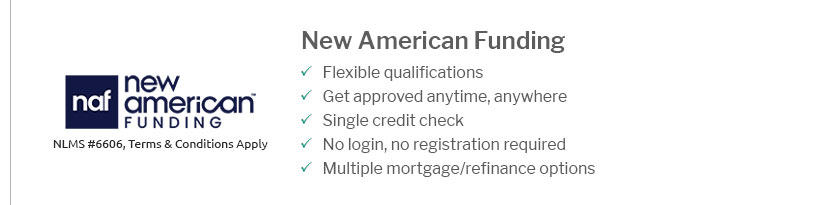

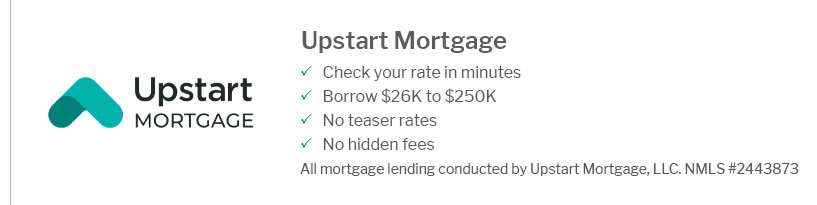

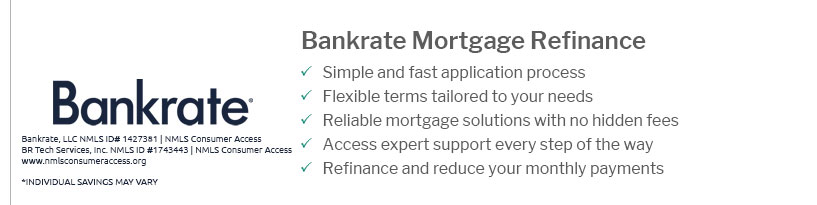

To explore current refinance rates for home loans, be sure to compare different lenders and their offerings. Eligibility and RequirementsRefinancing while in Chapter 13 requires meeting certain criteria: Approval from the Bankruptcy CourtThe court must approve any refinancing arrangement to ensure it aligns with your repayment plan. Good Payment HistoryMost lenders require that you've made at least 12 months of on-time payments under your Chapter 13 plan. Steps to Refinance

Potential ChallengesRefinancing during Chapter 13 isn't without its challenges:

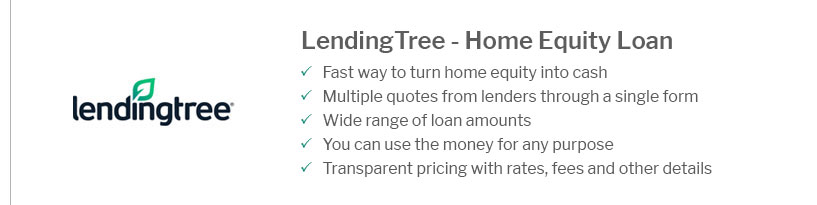

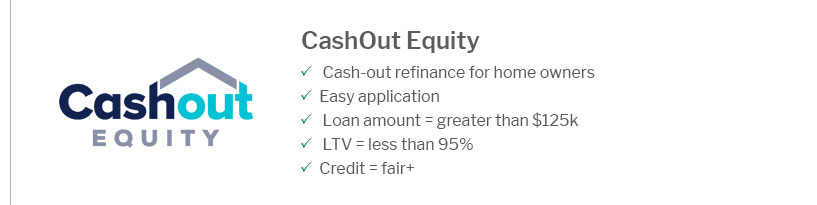

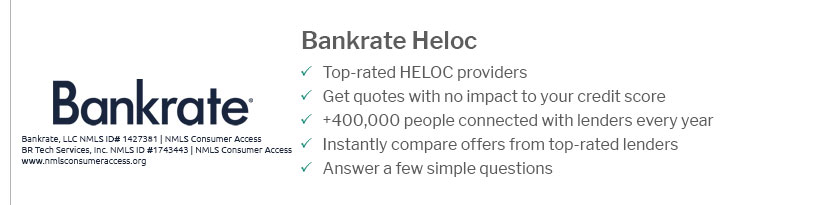

Veterans seeking specific options can check current VA home refinance rates for potentially favorable terms. Frequently Asked QuestionsCan I refinance my mortgage during Chapter 13?Yes, refinancing during Chapter 13 is possible, but it requires court approval and a good payment history. What documents are needed to refinance during Chapter 13?You'll need tax returns, pay stubs, and a motion approved by the bankruptcy court. Are there benefits to refinancing during Chapter 13?Benefits include potentially lower interest rates, more manageable payments, and access to home equity. https://www.cacb.uscourts.gov/the-central-guide/chapter-13-refinance-real-property

LBR 3015-1(p) provides the procedure for a chapter 13 debtor to file a motion to refinance real property. https://www.willamettevalleybank.com/buying-a-house-after-bankruptcy

Many borrowers are also wanting to pay off their Chapter 13 balance in full and look to obtain an early discharge with a cash out refinance. If you have enough ... https://www.jvmlending.com/loan-types/chapter-13-bankruptcy-refinance/

Refinancing your mortgage during Chapter 13 can provide a means of achieving financial stability and a pathway to a fresh start.

|

|---|